The stock market is certainly the groundwork for building riches. From multinational companies to individual shareholders, millions of folks rely on it in order to grow estate assets in addition to achieve make more money. But success in stock trading doesn’t discover luck—it demands knowledge, setting up, and discipline.

This comprehensive guide explores the most efficient stock market strategies for equally beginners and advanced traders. It emphasizes technical analysis, risk management, and actionable techniques like as swing trading, day trading, and even trend-following. You'll learn to read charts, work with technical indicators, examine price movements, plus execute stock trading with confidence.

just one. Comprehending the Basics regarding the Stock exchange

Prior to diving into advanced trading strategies, it’s crucial to realize how the stock market works.

Just what stock?

A stock signifies ownership in a company. When a person buy a stock, you purchase a little piece of of which business.

What is the stock market?

The particular stock market is a market place where stocks are usually bought and offered through exchanges like the NYSE in addition to NASDAQ.

Why do stock prices modification?

Stock prices change based on source and demand, motivated by news, income reports, economic indications, and investor belief.

Understanding these stock market basics is necessary before using any investment strategy.

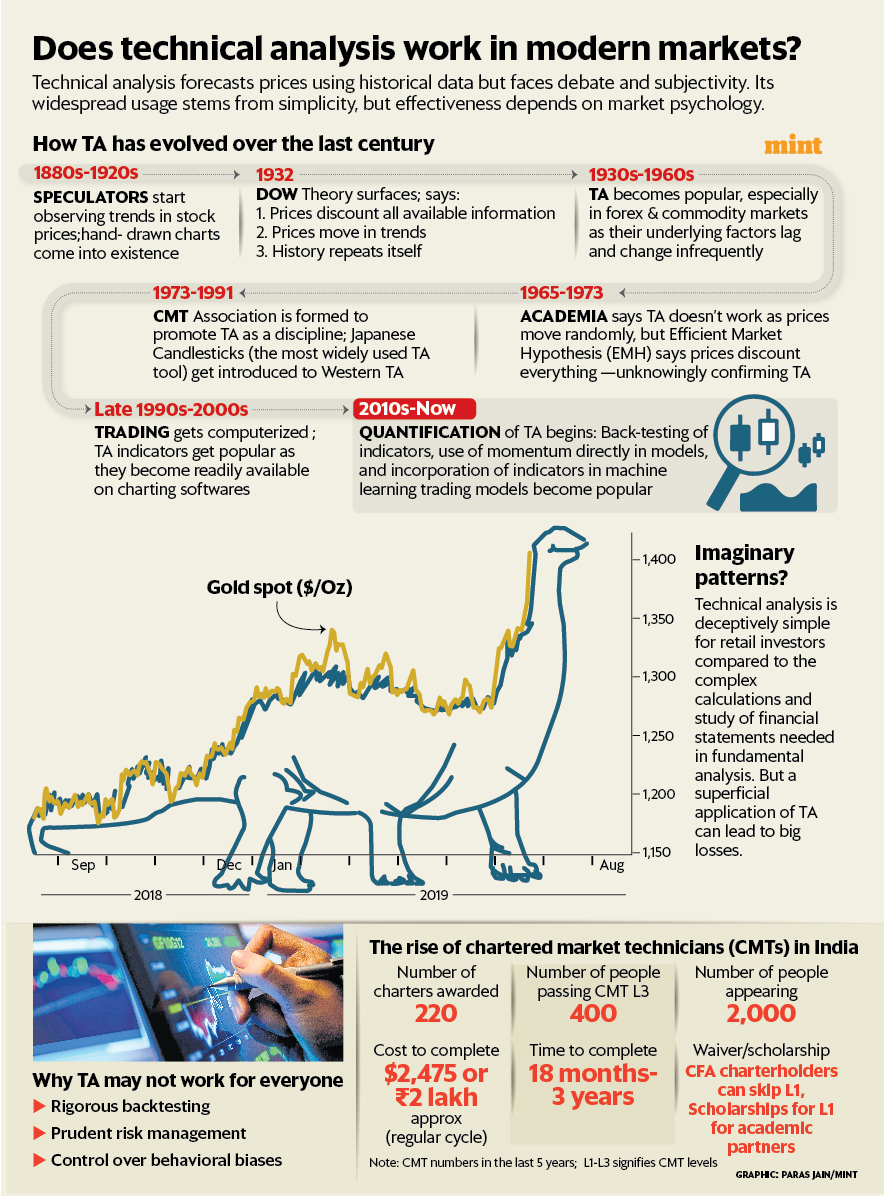

2. The Power of Technical Research

Technical analysis entails studying historical value data and quantity trends to predict future price actions. It’s one regarding the most widely used methods in stock trading.

Popular technical resources:

Moving Averages (MA) – Help identify the direction of your trend.

MACD – Signals momentum and even trend reversals.

RSI (Relative Strength Index) – Indicates overbought or oversold circumstances.

Bollinger Bands – Measure market unpredictability.

Fibonacci Retracement – Helps identify possible pullback levels.

Understanding these tools improves your technical trading strategy.

3. Recognizing Graph and or chart Designs

Chart designs are visual diagrams of price movements that help anticipate future trends.

Commonplace chart patterns:

Brain and Shoulders – Indicates a pattern reversal.

Double Top/Bottom – Shows help or resistance.

Triangles – Often sign a continuation associated with the current tendency.

Flags and Pennants – Mark immediate consolidation before some sort of breakout.

These designs are essential in order to building an effective chart analysis method.

4. Multi-Timeframe Analysis

Multi-timeframe analysis involves using multiple graph intervals (e. h., monthly, weekly, daily) to validate developments and refine items.

Monthly/Weekly charts – Show long-term marketplace direction.

Daily graphs – Highlight golf swing trade opportunities.

Intraday charts – Finest for day trading setups.

This layered method helps eliminate phony signals and enhances trade accuracy.

5. Understanding Volume throughout Trading

Volume displays how many shares are traded during a given time and helps confirm the strength of any tendency.

Volume indicators:

On-Balance Volume (OBV) – Measures buying/selling pressure.

Volume Moving Common – Smooths surges to show legitimate interest.

Accumulation/Distribution Series – Detects institutional activity.

High quantity with price movements confirms a strong market trend.

a few. Swing Trading compared to. Daytrading

Both will be popular short-term stock trading strategies with distinct styles:

Swing Investing:

Holds trades intended for 1–10 days

Employs chart patterns and even technical indicators

Suitable for people who have limited screen time

Working day Trading:

Closes jobs within the same working day

Focuses in intraday unpredictability

Calls for speed, focus, in addition to real-time analysis

Equally rely on being familiar with support and resistance and using resources like RSI in addition to MACD.

7. Eruption Trading and Traction Method

These methods strive for quick revenue through rapid marketplace movements.

Breakout Buying and selling:

Enters on value breakout from a new consolidation region

Concurs with using strong volume level

Uses stop-loss merely below breakout level

Momentum Trading:

Is targeted on stocks with robust price action

Uses RSI, stochastic oscillators, plus volume scanners

Suitable for traders chasing pre-market movers

8. Mastering Risk Management

Zero strategy succeeds with no solid risk handle.

Risk rules:

Threat only 1–2% for every industry

Maintain a minimum 1: two risk-to-reward rate

Employ stop-loss orders consistently

Avoid revenge stock trading

Protecting capital is definitely more important as compared to chasing big is victorious.

9. The Part of Trading Mindset

Your mindset is a key factor in long-term trading success.

Discipline – Stick to your own trading psychology strategy

Patience – Await high quality setups

Confidence – Trust your technical analysis

Resilience – Find out from losses with out overreacting

Keeping some sort of trading journal may help improve your emotional control and regularity.

10. Combining Specialized and Fundamental Analysis

Combining both research methods enhances your own overall trading benefits.

Use fundamentals (e. g., earnings, earnings, debt) to uncover strong stocks

Use specialized indicators to moment your entries in addition to exits

This cross approach is perfect for long lasting investors and job traders.

11. Top Technical Indicators with regard to Stock Traders

Indicator Purpose

MACD Trend and traction analysis

RSI Identifies overbought/oversold

Bollinger Bands Measures volatility

Volume Profile Shows superior activity price ranges

Fibonacci Retracement Predicts retracement ranges

Use these kinds of in combination to be able to improve technical technique performance.

12. Setting up Your Own Stock trading Technique

Your trading system should line up together with your schedule, money, and risk ceiling.

Trading strategy theme:

Market filter: Only trade stocks together with high volume and liquidity

Setup criteria: Define your excellent trade pattern or indicator indicators

Admittance trigger: What agrees with your buy or sell actions

Stop-loss rule: Protects against large losses

Exit plan: Fixed a profit focus on or trailing halt

Always test your system which has a demonstration account first.

thirteen. Using Stock Screeners to Find Trades

Stock screeners conserve time by blocking thousands of tickers.

Top free screeners:

Finviz – Greatest for technical patterns

TradingView – Real-time scans and notifies

Yahoo Finance – Great for blocking by fundamentals

Illustration filters:

Volume > 1 mil

Price > $5

RSI < 30 (oversold setup)

14. Tips on how to Track Your Trades and Performance

Keep on a trade diary with:

Entry plus exit points

Strategy used

Profit or even loss

Screenshots associated with setup charts

Take a look at trades weekly to discover winning patterns and improve your results.

15. Final Ideas: From Theory to be able to Execution

Success inside the stock market is not about predicting—it’s about preparing. By applying proven stock trading tactics, staying disciplined, plus adapting to market conditions, you give on your own the best possiblity to build sustainable wealth.

Key reminders:

Constantly trade with a plan

Let data show you, not emotion

Practice and improve on a regular basis

Prioritize risk management